How I Paid Off My Student Loans

So you know, this sign should read: “$18,702 paid in 12 Months. Debt Free!” But, this is how it worked out. lol

Getting out of debt was a goal I began to take seriously around November of 2018.

My dad and my brother had been heavily invested in Dave Ramsey’s programming, and they would regularly share stories and learnings they heard or read about with me and my mom, and especially, when we were all together. My dad even bought me a book called “Love Your Life Not Theirs” to further pique my interest, which I shared with you all earlier this year.

I would hear them dream out loud of becoming “weird people” or people with no debt and making future investments that would sit and grow exponentially on its own.

Together, we would talk about building wealth so that we could create a legacy and share the responsibility of giving back to those in need.

Needless to say, they watered a seed that had been planted in years prior, inspired and supported me every step of the way on my road to becoming debt-free; I hope to do the same for you.

I want to position this in the most simplistic and holistic way possible for you to understand my journey. I graduated college 5 years ago with $26k in debt. I only took out around $22k, but with interest, that was where it capped: $26k. I thought the $4k might have been all I would have to donate in interest, but I quickly learned that interest would accrue daily on top of the minimum payment I owed a month.

Over the years post-graduation and up until November 2018, I had paid roughly $13,000 since graduating, yet I still owed about $19,000. It’s a sick business.

Excerpt from Love Your Life Not Theirs.

My plan was simple: throw as much money as I can afford on my student loans within the framework of Dave Ramsey’s Baby Steps, which are bulleted below.

Save $1,000 for Your Starter Emergency Fund

Pay Off All Debt (Except the House) Using the Debt Snowball

Save 3–6 Months of Expenses in a Fully Funded Emergency Fund

Invest 15% of Your Household Income in Retirement

Save for Your Children’s College Fund

Pay Off Your Home Early

Build Wealth and Give

There are no shortcuts. As Dave encourages his following, “live like no one else, so you can live like no one else.”

You have to be willing to see your hard-earned income and tax refunds deposit into your bank account and leave again the same day. You have to be willing to make sacrifices on things you want or that Social Media entices you to desire. You have to let go of frivolous and/or excess commodities and expenses that will hurt your end goal.

For me, this was a solid tradeoff for a journey that was finite. I wanted to be out of debt in or under a year, so I calculated exactly how much I could pay per month, and I did my best to stick to it.

I got paid, then I paid my bills.

I got paid, then I paid my student loans.

This was the cycle I repeated, keeping only a few dollars for myself here and there to stay afloat.

My satisfaction came every time I dropped a payment and watched my balance drop. 19, 18, 17, 16…I was on my way to freedom. That is the freedom to live, give, and create.

I did get to a point, literally, as I was maybe two payments from my goal, where I felt so broke and weary that I didn’t make the payment I committed myself to making. Instead, I kept it for myself. I went to brunch, got my hair done, bought a new dress and purchased a few other things that I deprived myself of for the sake of becoming debt free.

Four words: it was worth it. After this, I was ready to finish the drill.

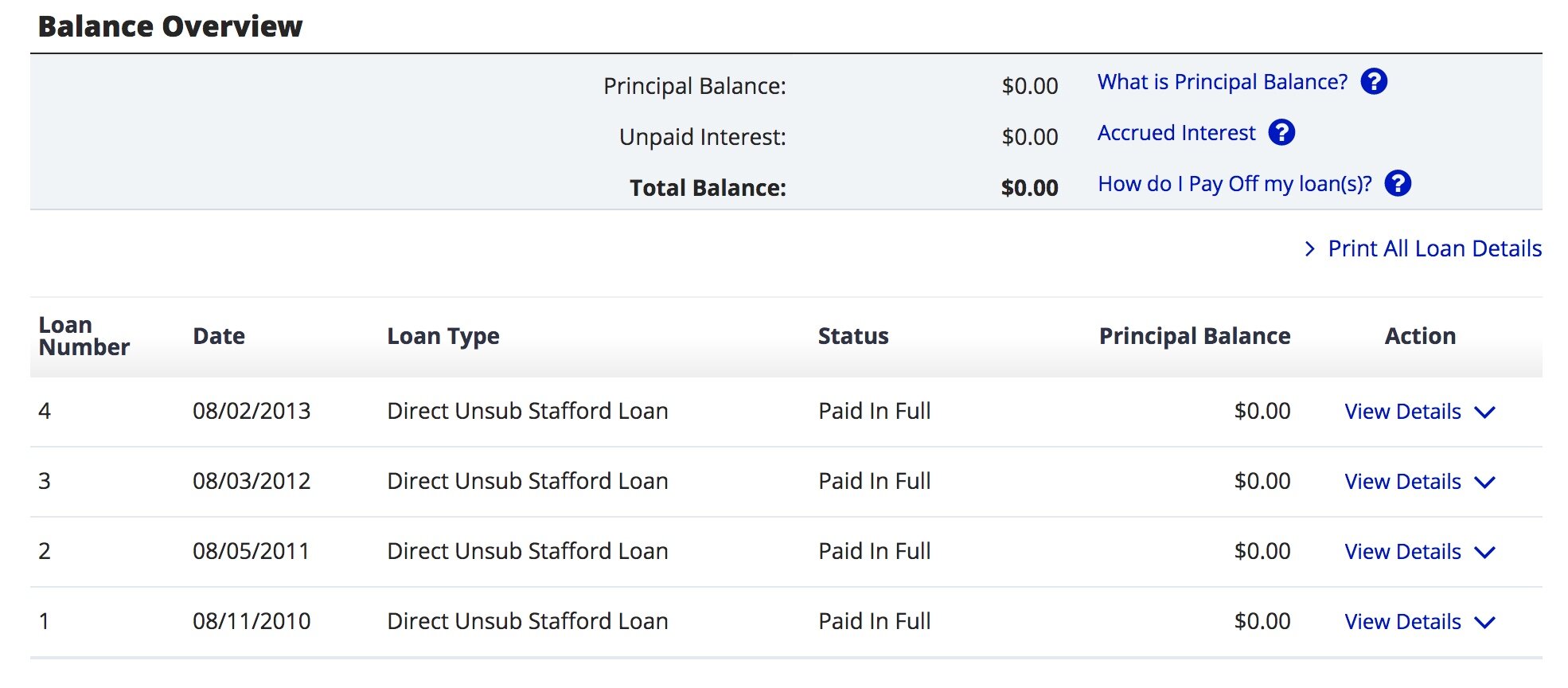

All in all, I paid ~$33,000 to the department of education. When I log into Fedloan Servicing, this is the image I see:

My advice to anyone who wants to do the same is you too can get out of debt with a plan that works for you.

Research the baby steps and the debt snowball

Figure out the goal time(this is between you and you) for you to pay off your debt

Create a plan that works for you

Stay focused; don’t get sidetracked by what everyone else is doing

The journey is finite - it’s not forever

Don’t forget the why, which is Step 7: Build Wealth and Give

“You know what people with no debt can do? Anything they want! The last step is the most fun. You can live and give like no one else! Keep building wealth and become insanely generous. Leave an inheritance for your kids and their kids. Now, that's what we call leaving a legacy!” - Dave Ramsey

Of course, I’m still working on the baby steps, so I’m no expert, but I’m here to encourage someone else to get started.

If you have any questions, sound off in the comments. Though my journey won’t look like yours or the next and vice versa, we can all set our selves and our families up for generations to come.

Lastly, thanks to God, my mom, dad and brother for continually giving me what I need and challenging me to go above and beyond. I couldn’t have done it without them.